🚀 Booming Industry, Bigger Opportunity

The fintech industry is exploding in 2025 — and so is the need for loan professionals. As the world shifts from brick-and-mortar banking to smart, AI-powered platforms, roles like Loan Processor, Credit Analyst, and Loan Officers are in high demand.

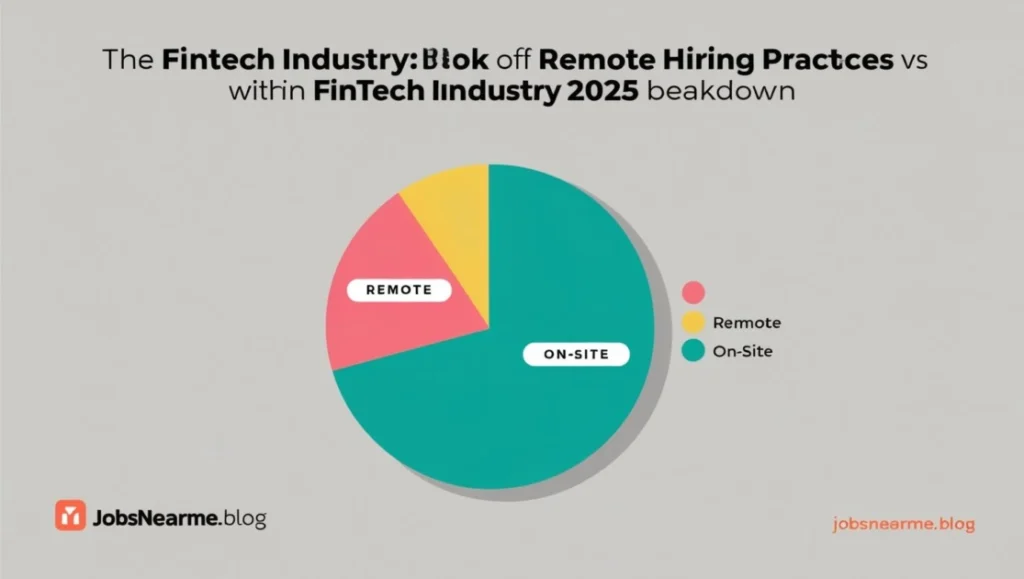

Whether you’re seeking remote flexibility or on-site stability, these top 10 fintech companies are actively hiring in the loan sector right now. And yes — they’re offering great pay, benefits, and career growth in the process.

Let’s dive into the opportunities — and how you can land your dream fintech loan job this year.

✅ 1. Why Fintech is the Future of Loan Jobs

- 📊 AI + Automation means faster underwriting & smart credit checks

- 🌍 Remote-first startups = more work-from-home options

- 💸 Competitive pay that often beats traditional banking

- 🚀 Faster career growth in startups than old-school finance

Fintechs aren’t just hiring — they’re building lean, diverse teams who can handle modern lending challenges.

✅ 2. Top 10 Fintech Companies Hiring for Loan Jobs in 2025

🏦 1. SoFi

- Roles: Loan Officers, Underwriting Analysts, Support Specialists

- Apply: SoFi Careers

- Remote Friendly: ✅ Yes

- Perks: Stock options, flexible hours

💸 2. Upstart

- Roles: Risk Analyst, AI Loan Automation Lead

- Known for: AI-powered lending

- Remote: ✅

🔐 3. Figure

- Roles: Blockchain Mortgage Advisors

- Trend: Web3 meets lending

- Hybrid: ✅

📈 4. LendingClub

- Roles: Loan Processing, Credit Evaluation

- Growth: Publicly listed + aggressive expansion

- Apply directly at: LendingClub Careers

🇬🇧 5. Zopa (UK)

- Roles: Digital Lending Assistant, Loan Advisor

- Location: UK Remote / Hybrid

- P2P lending pioneer

🌐 6. Tala

- Roles: Product Managers, Risk & Credit Leads

- Market: Emerging countries

- Mission: Lending for financial inclusion

🤖 7. Avant

- Roles: Collections, Servicing Reps, Loan Officers

- Focus: Consumer loans with a tech twist

- Hybrid: ✅

📊 8. Prosper

- Roles: Loan QA Analyst, Processing Specialist

- Flex: Remote-first culture

🧠 9. Kabbage (American Express)

- Roles: SMB Loan Officers, Credit Specialists

- Benefit: Amex-grade benefits and pay

- Remote: ✅

💻 10. Credible

- Roles: Student Loan Advisors, Mortgage Ops Analysts

- Work Culture: Startup + fintech

- Remote: ✅

🔗 Explore Live Jobs:

Click below to explore current openings by job title:

- 👉 Loan Processor Jobs

- 👉 Credit Analyst Jobs

- 👉 Fintech Customer Support Jobs

- 👉 Loan Officer Remote Jobs

- 👉 Underwriting Jobs

✅ 3. What Kind of Loan Jobs Are Hot in Fintech?

| Job Title | Skills Needed | Avg. Salary (USD) |

|---|---|---|

| Loan Processor | CRM tools, attention to detail | $50K–$70K |

| Credit Analyst | Risk modeling, Excel, SQL | $65K–$90K |

| Loan Officer | Lending laws, customer service | $55K–$85K |

| Risk Manager | Data analysis, fintech law | $75K–$110K |

| Fintech Support | Communication, KYC/AML knowledge | $40K–$60K |

✅ 4. How to Get Hired in Fintech Loan Jobs

- ✨ Optimize your LinkedIn: Use headlines like “Loan Analyst | Fintech Enthusiast | Open to Work”

- 📝 Add keywords: Include “loan origination”, “fintech CRM”, “credit modeling” in your resume

- 📬 Apply smart: Use AngelList, company career sites, and niche fintech job boards

- 🤝 Connect on LinkedIn: Reach out to current employees or recruiters with a personalized DM

🎓 5. Bonus Certifications That Give You an Edge

- Certified Loan Officer (CLO) – Ideal for entry-level applicants

- Credit Risk Analyst (CRA) – Adds weight for credit/underwriting roles

- Fintech Essentials – Wharton (edX) – Great for industry context

❓ People Also Ask (FAQs)

Which fintech companies are hiring in 2025?

SoFi, Upstart, Figure, LendingClub, and many others are actively hiring.

Are fintech loan jobs remote?

Yes, many roles now offer remote and hybrid options across regions.

What skills do I need for a fintech loan job?

CRM tools, credit evaluation, underwriting basics, and soft skills like communication.

Can I apply without banking experience?

Yes! Fintechs often hire from diverse, non-banking backgrounds.

✅ Apply Now – Don’t Wait!

The loan job market in fintech is buzzing, and the earlier you apply, the better your chances. Whether you’re a seasoned underwriter or a fresh grad looking to enter the field — there’s a place for you in this booming sector.

🔗 Start with these searches:

💼 Ready to launch your fintech career? Apply now and take the next big step.